The United Arab Emirates (UAE) has a remarkably low corporate tax rate when compared to other nations; because of this, it is often chosen by companies seeking to establish a presence in the Middle East. The usual corporate tax in UAE is 55% for oil firms and 50% for all other businesses. In addition, the UAE has various free-trade zones where businesses could operate tax-free.

The United Arab Emirates (UAE) has no personal or corporate income tax, making it an attractive location for businesses. This is a very attractive feature for international businesses to consider when choosing where to establish their business. The government has also introduced a number of tax breaks and other exemptions in the hopes of bringing in more overseas investors.

The United Arab Emirates (UAE) has a Value-Added Tax (VAT) system in place where most products and services are taxed at a rate of 5%, with occasional exemptions for commodities like medical supplies and food. Although there are no corporate taxes in the United Arab Emirates (UAE), a Value-Added Tax (VAT) of 5% is levied on most purchases, with exceptions made for necessities like food and medicine.

The UAE has a number of double taxation agreements (DTAs) with foreign nations. The goal of these agreements is to prevent a person who is a resident of one nation but earns money in another country from having to pay taxes on both of those incomes. This makes it simpler for businesses to do business across international boundaries and reduces the burden of taxation placed on foreign companies that conduct business in the UAE.

In a word, the United Arab Emirates (UAE) makes it easier for businesses to succeed by not charging personal income taxes, having tax-free zones, and having low corporation tax rates. Because of the government’s efforts to encourage international investment and the country’s double tax arrangements, it is an ideal location for businesses that are interested in expanding their operations to other regions of the world.

Why is it essential to make use of RealSoft ERP when dealing with corporate tax in UAE?

Enterprise resource planning (ERP) software is becoming more effective in the administration of corporate taxes. An enterprise resource planning (ERP) system is a kind of software programme that integrates and automates a number of different business operations, including those related to accounting, finance, and human resources. Businesses that use an ERP system are able to centralise all of their financial information in one location, which makes it much simpler to monitor and handle their tax obligations.

For instance, an ERP may facilitate company tax compliance in the following ways:

Accurate and timely financial reporting: Quick and accurate financial reporting is possible because of the ability of an ERP system to gather and keep financial data from different areas, including sales, purchasing, and inventory. These data could be used to develop accurate financial reports, such as income statements and balance sheets, which are essential for assessing corporate taxes.

Compliance with tax regulations: By generating the appropriate data and reports, such as VAT and GST returns, tax declarations, and tax certifications, an ERP system may assist firms in remaining compliant with local, national, and international tax requirements.

Automated tax calculation: On the basis of the financial information that it has gathered, an ERP system is able to do an automated calculation of several types of taxes, including sales tax and value-added tax. This can assist in lowering the probability of making errors and ensuring that appropriate tax estimates are made.

Improved forecasting and budgeting: An ERP system is able to provide real-time financial data that can be used to forecast and budget for future tax payments. This helps the business better manage their cash flow and avoid paying late fees for tax payments.

Audit Tracking: An ERP system may preserve a record of all financial transactions and modifications, producing an audit trail that can be helpful in the event that a tax audit is conducted.

In general, an enterprise resource planning (ERP) system may assist organisations in managing their corporate taxes in a manner that is more effective, accurate, and in compliance with the applicable regulations.

How RealSoft ERP Can Help

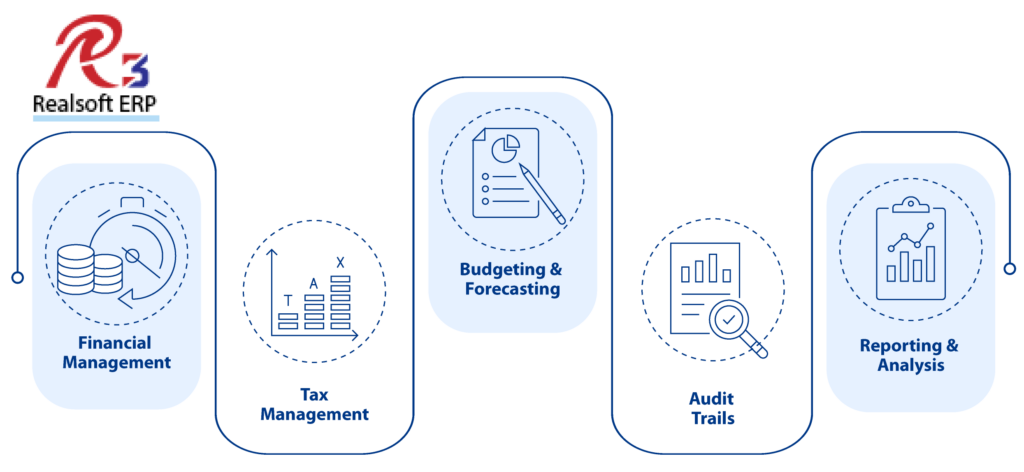

RealSoft ERP, the enterprise resource planning software could be used to handle corporate taxation. RealSoft ERP provides a variety of capabilities that may improve the tax management process for businesses, including:

Financial Management: RealSoft ERP offers a comprehensive financial management system for managing all financial activities, including billing, accounts payable and receivable, and the general ledger. This may be beneficial when creating the precise financial reports required for computing corporate taxes.

Tax Management: RealSoft ERP has a tax management module that may assist organisations in complying to local, regional, and worldwide tax regulations. This module may be used to automate the computation of various taxes, including sales tax and value-added tax, and prepare tax returns and declarations.

Budgeting and Forecasting: RealSoft ERP includes budgeting and forecasting capabilities for planning future tax bills and cash flow management. This may assist companies in avoiding late payment fines.

Audit Trails: RealSoft ERP maintains track of all financial transactions and modifications, thereby generating an audit log that might be valuable during a tax audit.

Reporting and Analysis: RealSoft ERP includes a number of reporting and analytical tools for evaluating financial data and generating reports, including balance sheets, income statements, and cash flow statements. This is beneficial for detecting tax-related difficulties and making wise decisions.

Using RealSoft ERP, companies may improve their tax management process, maintain compliance with tax regulations, and make much better intelligent choices.